The U.S. Job Market Slowdown & Workforce Strategies

In 2025, the U.S. labor market experienced significant changes. Hiring rates declined, unemployment increased slightly, and workforce mobility decreased. According to a recent Wall Street Journal article, “America’s Job Market Has Entered the Slow Lane,” Justin Lahart and Danny Dougherty identify 2025 as a pivotal year following a period of historically tight labor conditions. Their analysis emphasizes reduced job growth, contractions in specific sectors, and a workforce that is increasingly reluctant to change positions.

The labor market slowdown presents direct challenges for workforce leaders, impacting retention, scheduling stability, and operational planning. Employee uncertainty, even as turnover declines, increases the risks of burnout, disengagement, and absenteeism. Organizations that proactively adjust workforce strategies will be better equipped to sustain coverage and performance amid ongoing uncertainty.

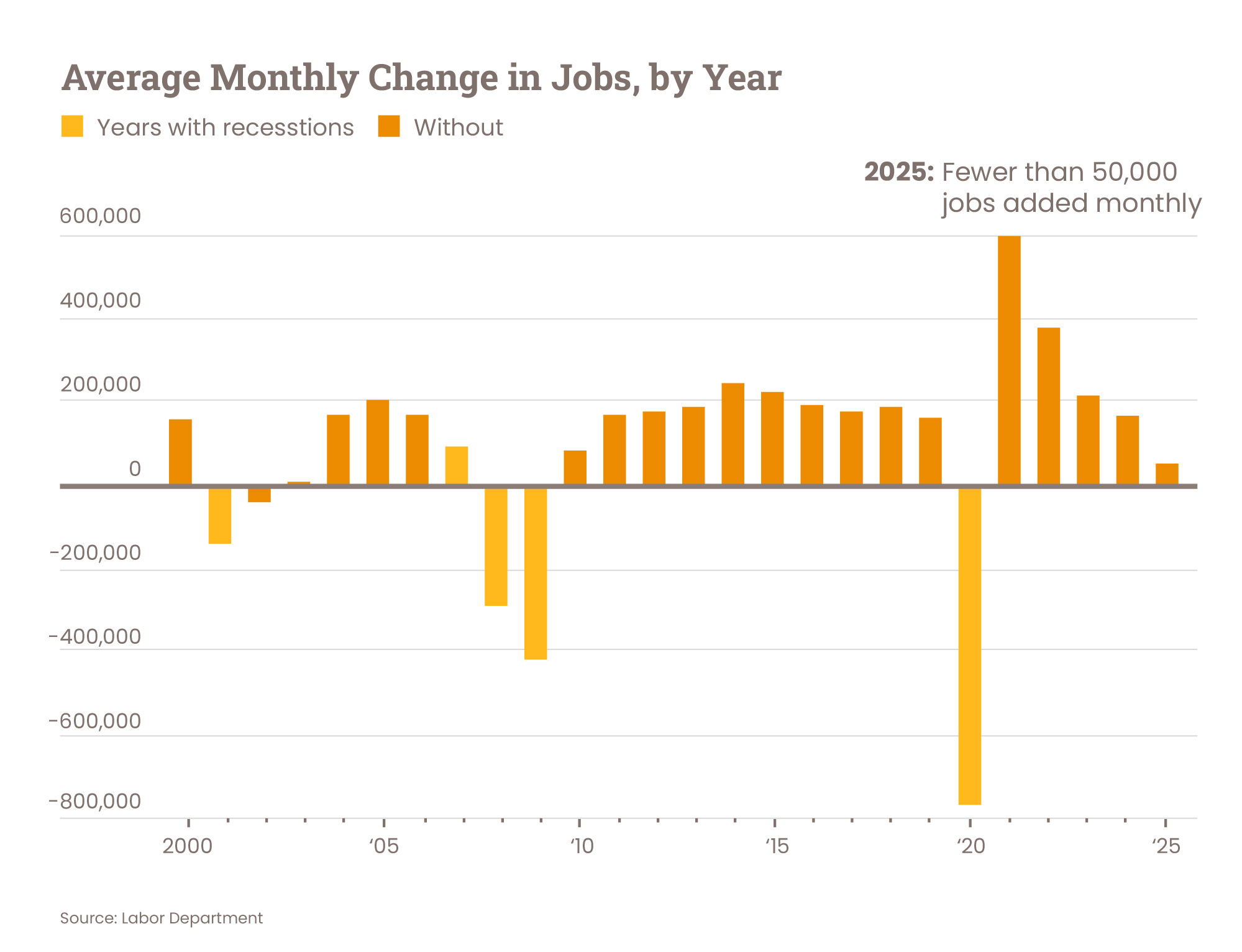

Job Growth Slowed Sharply in 2025

Employment growth slowed markedly in 2025, with the U.S. economy adding only 584,000 jobs, or approximately 49,000 per month. This represents a substantial decline from the 168,000 monthly average in 2024 and constitutes the weakest job growth rate outside of recent recessions in over twenty years.

Multiple factors contributed to this slowdown. Organizations reduced hiring due to uncertainty regarding trade policy, government layoffs, and the potential impact of artificial intelligence on workforce requirements. Additionally, prominent layoffs discouraged employees from seeking new positions, further diminishing hiring momentum.

For employers, a slower hiring environment results in fewer external candidates and extended time-to-fill for open positions. Consequently, workforce stability relies heavily on retaining current employees and leveraging internal flexibility to address operational needs.

Why Unemployment Remains Low Despite Slower Hiring

Despite slower hiring, the unemployment rate increased only slightly, ending 2025 at 4.4 percent compared to 4.1 percent the previous year. The rate remains low by historical standards. Economists attribute this relative stability in unemployment to a declining labor supply.

Net immigration fell sharply in 2025, from more than 2.2 million in the previous year to approximately 410,000, according to Congressional Budget Office estimates. With fewer new entrants to the labor force, the economy requires fewer job additions to sustain a stable unemployment rate.

For workforce planning, constrained labor availability persists despite reduced hiring activity. Organizations cannot depend on expanding labor pools to address coverage gaps. As a result, internal workforce management has become increasingly important during the labor market slowdown.

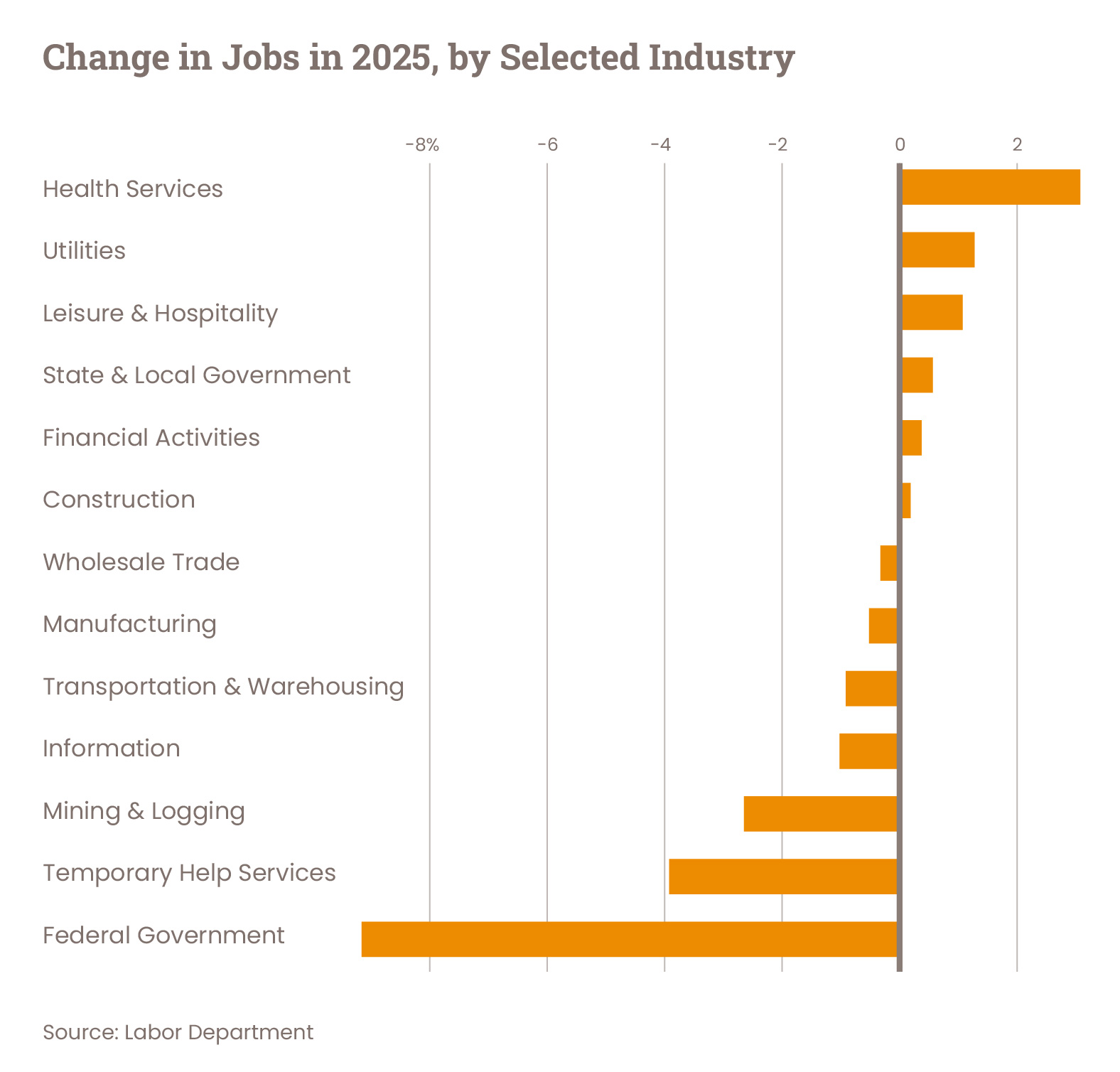

Sector Shifts Create Uneven Workforce Pressure

Job growth in 2025 was uneven across sectors. Healthcare and social assistance accounted for the majority of employment gains, adding over 700,000 jobs due to increased demand from an aging population. Leisure and hospitality experienced modest growth, supported by sustained spending among higher-income households.

On the other hand, sectors such as manufacturing, transportation, warehousing, and temporary help services experienced job losses. The federal government also eliminated approximately 274,000 positions, further contributing to employment declines among specific worker groups.

These sectoral disparities present significant challenges for workforce leaders. Operations teams in labor-intensive industries encounter unpredictable staffing requirements amid limited hiring activity. Flexible scheduling and internal coverage strategies are now essential rather than optional.

A Low-Fire, Low-Hire Environment Raises Retention Risks

A defining characteristic of the current labor market is the so-called low-fire, low-hire environment. Employers are not conducting widespread layoffs, yet they remain reluctant to hire new staff. In response to this uncertainty, workers are increasingly opting to remain in their current positions.

The current labor market poses additional barriers for younger workers and recent graduates seeking entry into the labor market. It has also contributed to increased unemployment among African American workers, whose unemployment rate rose to 7.5 percent in December from 6.1 percent the previous year. Historically, rising unemployment among African American workers has often preceded broader labor market downturns.

A stagnant labor market may obscure underlying workforce challenges for employers. Employees may remain employed while experiencing increased stress, diminished engagement, and restricted opportunities for advancement. Without proactive workforce planning, these issues may later manifest as absenteeism, scheduling conflicts, and turnover.

Wage Growth Is Cooling but Financial Pressure Persists

Wage growth has moderated as well. Average hourly earnings increased by 3.8 percent year over year in December, a slight decrease from the 4 percent growth recorded the previous year. Although wages still outpace inflation, the differential has diminished.

For frontline workers, the combination of slower wage growth and rising living costs intensifies financial stress. Employees may pursue additional hours, secondary employment, or increased scheduling flexibility to sustain income stability. During the labor market slowdown, effective scheduling is a critical tool for supporting both workforce well-being and operational continuity.

Workforce Flexibility in a Slower Job Market

In periods of slow hiring and extended employee tenure, workforce flexibility serves as a competitive advantage. Rigid scheduling increases the risk of burnout, whereas flexible systems enable organizations to manage fluctuations in demand without increasing headcount.

Tools such as internal shift management software, voluntary time-off options, and transparent scheduling practices help employees manage income uncertainty while ensuring adequate coverage. These approaches also reduce last-minute absences and the manual scheduling burden on managers.

In a slower labor market, workforce technology provides stability by facilitating rapid communication, improved visibility into labor availability, and controlled access to additional work hours. Organizations that invest in flexible systems are better positioned to sustain performance as external labor conditions become more restrictive.

Planning for Stability After the 2025 Labor Market Slowdown

The 2025 labor market slowdown marks a transition from rapid hiring to a focus on operational optimization. Workforce leaders are encouraged to prioritize strategies that improve organizational continuity over expansion.

Key priorities include:

- Retaining experienced employees through predictable and flexible scheduling.

- Reducing reliance on external hiring to fill short-term gaps.

- Empowering employees with greater control over shifts and hours.

- Using workforce data to identify early signs of burnout or disengagement.

Organizations that implement adaptive strategies now will be better prepared for future increases in hiring activity. Stable teams supported by flexible systems can respond more rapidly to changes in demand and sustain higher service levels.

Although the U.S. job market has transitioned to a slower phase, workforce challenges remain multifaceted. Reduced hiring does not alleviate labor pressures; instead, it shifts the focus toward retention, employee engagement, and operational efficiency.

Start Planning for Success

Schedule a demo with ShiftSwap™ today and learn how to streamline your workforce management.